Australians with mortgages significantly increased their financial buffers last year, according to Reserve Bank of Australia data.

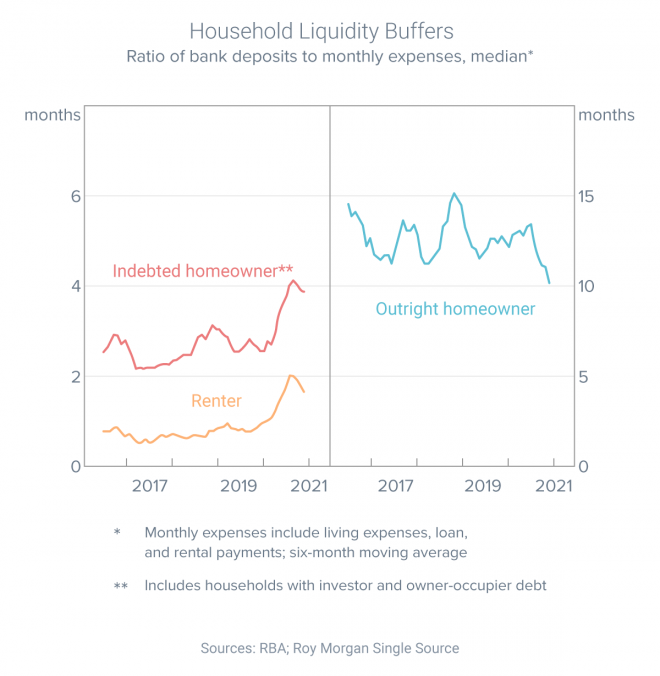

As the graph shows, indebted homeowners now have an average of four months worth of expenses in the bank.

That compares to less than two months for renters and 10 months for people who own their home outright.

The average household doubled their savings rate last year, to 12% of income, according to the Reserve Bank.

Those extra savings were used to pay down debt and/or increase financial buffers.

At the same time, lending standards are “largely unchanged and remain robust”.

In other words – borrowers have improved their individual financial positions while the banking system remains just as strong as before.